NSSF ACT 2013

Following a Court of Appeal ruling on 3rd February 2023, the National Social Security Fund Act 2013 has become operational and shall be implemented by all employers in Kenya. In this regard, the previous amount of Kshs 400 per employee under the NSSF ACT no longer applies

The NSSF Bill 2013 was passed by the National Assembly on 4th December 2013 and received presidential assent on 24th December 2013. It repealed the NSSF Act (Cap 258) and replaced it with the NSSF Act 2013.

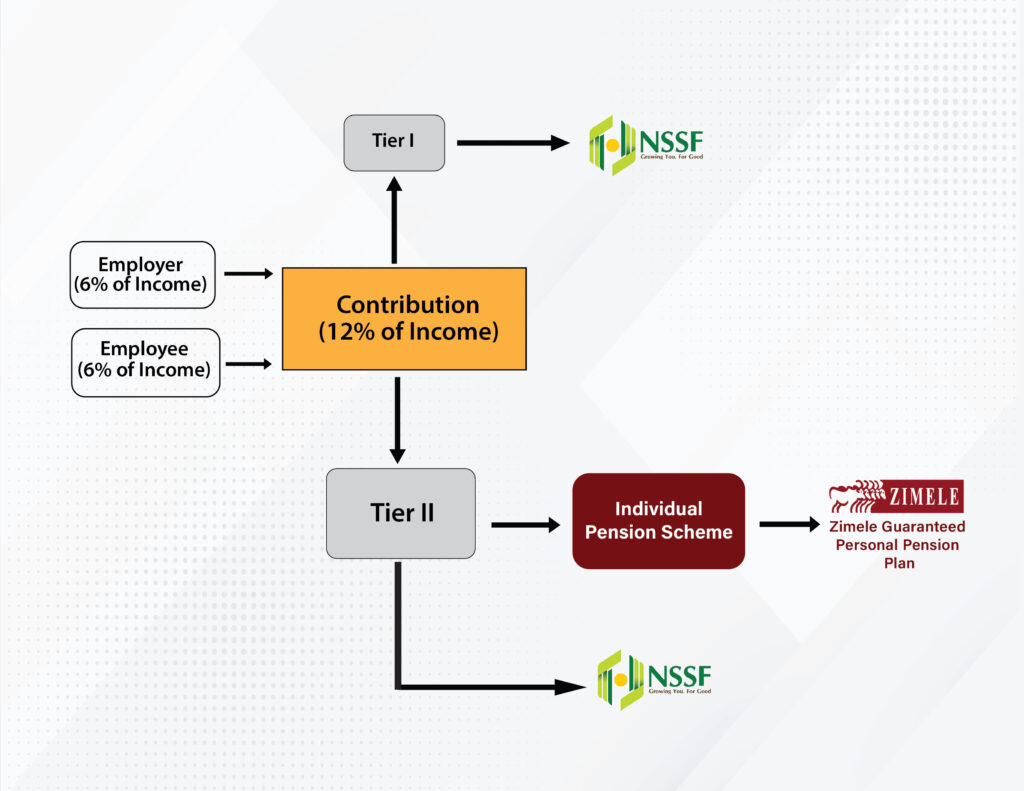

For the contributions of employers and their employees, the NSSF 2013 Act allows the employer to apply to pay their Tier 2 contributions to any other registered retirement scheme instead of the NSSF. This process is called Contracting Out. This opting out on Tier II contributions is provided under the regulations. We at Zimele remain available to assist employers and employees in navigating this legislation

The highlights of the NSSF Act 2013 include:

- Convert the existing NSSF from a provident fund to a pension scheme.

- Mandatory contributions are a total of 12% of a person’s earnings divided as follows:

- Employer contributions of 6%

- Employee contributions of 6%

- Contributions to the scheme are divided into two categories

- Tier I contributions: All is remitted to NSSF

- Tier II contributions: Goes to NSSF or to a registered private pension scheme of which the employee is a VALID member.

- Both Tier I and Tier II contributions are mandatory.

- All pension contributions are tax-deductible

- All employers with one employee or more are required to register with the NSSF and remit contributions every month.

Relevant Definitions from the Employment Act.

“employee” means a person employed for wages or a salary and includes an apprentice and indentured learner;

“employer” means any person, public body, firm, corporation or company who or which has entered into a contract of service to employ any individual and includes the agent, foreman, manager or factor of such person, public body, firm, corporation or company;

For Employers

If you would like to send your Tier 2 contributions to Zimele, we can help you with the contracting out process by following the process below. It’s as easy as 1,2,3.

- Download the C1 Form and the Employer Resolution Form below

- Fill out the Employer Resolution Form and Part I and IV of the C1 form

- Send the forms back to us by email to admin@zimele.net or by uploading them below

- We will handle the rest

For Employees

Employees who would like their Tier 2 contributions sent to Zimele can take the following steps;

- Open a Zimele Guaranteed Personal Pension Plan with us at www.zimele.co.ke/join

- Share with us the contact details of your employer below

- We will proceed to contact the employer to discuss the process with them